Liste Brokers No Dealing Desk

The ideal client of dealing desk brokers is the one who more or less breaks even in other words a client who neither wins nor losses at the end.

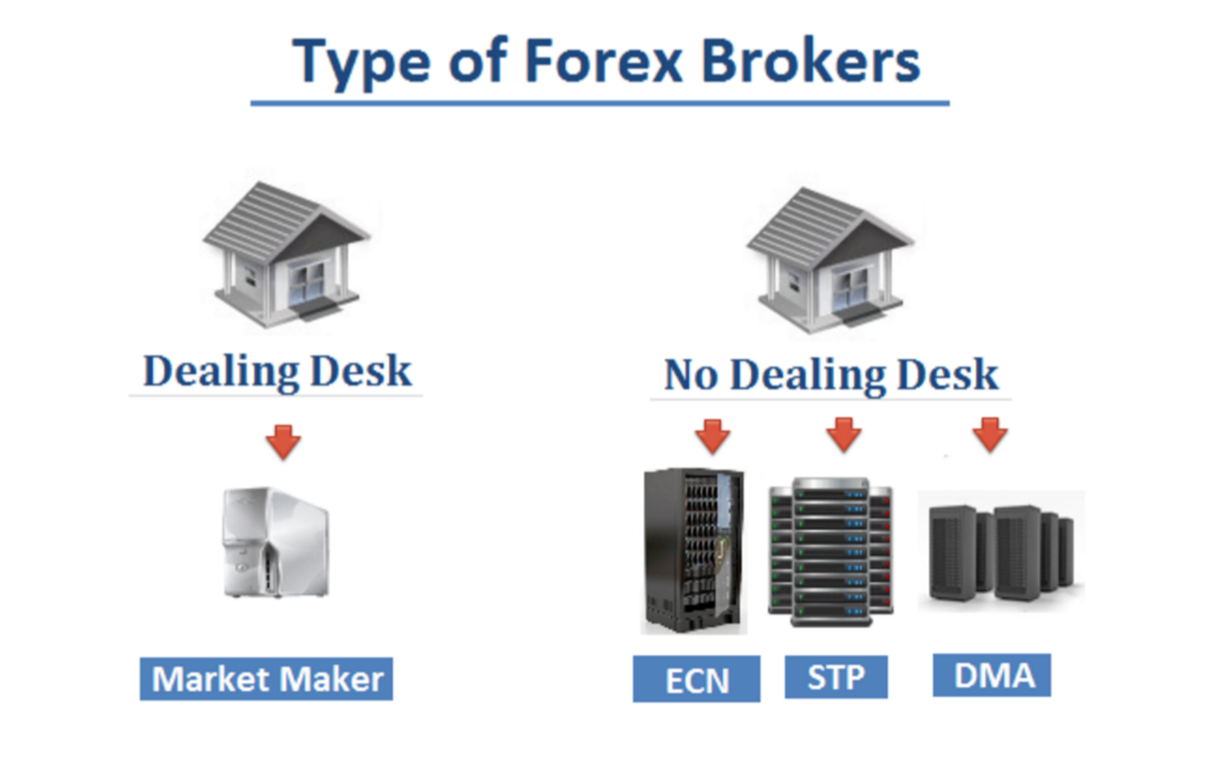

Liste brokers no dealing desk. Forex brokers can offer either dealing desk or no dealing desk execution models. This broker might not be regulated by a reputable financial regulator but has many years of experience on the forex market and has won numerous awards. Directorio de brokers ndd online. Let s go over each.

The ecn brokers electronic communication network the stp straight through processing and dma direct market access can be grouped in the great family of ndd brokers no dealing desk opposed to the market maker brokers which have a dealing desk. Or at best play an arbitration role in case of bigger disputes. Check your no dealing desk broker has the ability to get deposits and withdrawals processed within 2 to 3 days. Un broker ndd no se convierte en la contraparte de sus clientes durante las transacciones de estos en el mercado.

Stp compared to ecn execution. I d say the majority of forex brokers are dealing desk brokers. And both concerns are completely ridiculous. A dealing desk takes the other side of my trade and i don t like that.

Brokers offering a dealing desk are also acting as market makers. Los brokers de forex non dealing desk ndd ofrecen acceso directo al mercado interbancario ya que sirven de intermediarios entre los clientes y otros operadores. The ultimate guide to no dealing desk. Ecn brokers aren t safe because a crash can take them out of business and my money with it.

In most cases dealing desk brokers keep trades safely within their own liquidity pools and do not require external liquidity providers. Does the no dealing desk broker fall under regulation from a jurisdiction that can hold a broker responsible for its misgivings. Also called market makers also called market makers dealing desk brokers literally create a market for their clients meaning they often take the other side of a clients trade. They generally create their own liquidity setting the bid and ask price themselves and taking the opposite side of a client s trade.

In this execution model when you trade profitably you make money off the dealing desk broker. Dealing desk forex broker. They also offer no dealing desk trading on their pro accounts accessible by an initial investment of 100 and support both the mt4 and mt5. This is important when withdrawing funds.

That way the broker earns money on the client s transactions but at the same time the client stays in the game by not blowing out his account.

%2C445%2C286%2C400%2C400%2Carial%2C12%2C4%2C0%2C0%2C5_SCLZZZZZZZ_.jpg)